federal estate tax exemption 2020 sunset

Easy Fast Secure Free To Try. The federal estate tax exemption is set to sunset at the end of 2025.

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra

ClearEstate can save estate executors up to 120 hours and 8500 in fees.

. The federal estate tax exemption is set to sunset at the end of 2025. After that the exemption amount will drop back down to the prior laws 5 million cap. After 2025 the exemption amount will sunset a fancy way of.

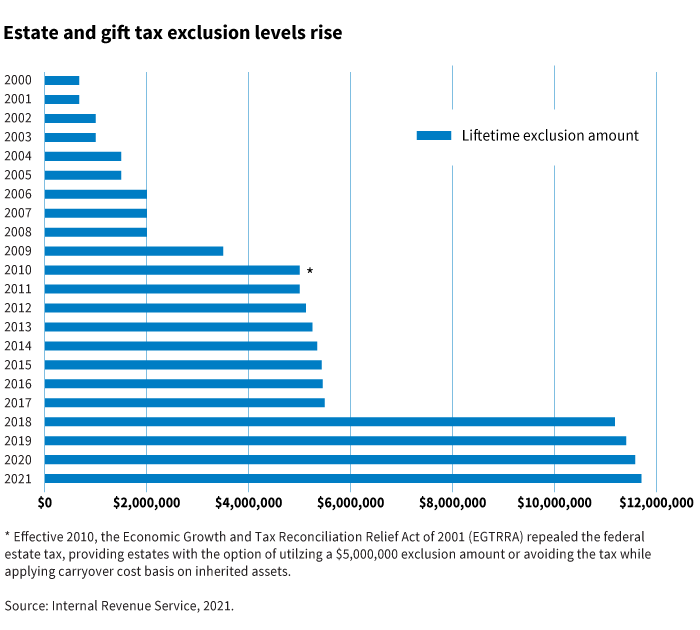

Real and personal property owned and operated by certain nonprofit organizations can be exempted from local property taxation through a program administered. The Economic Growth and Tax Relief. The Tax Cuts and Jobs Act TCJA of 2017 doubled the federal estate tax exemption but only for a limited number of years.

Download or Email IRS 872-B Form More Fillable Forms Register and Subscribe Now. Ad Do Your 2020 2019 2018 2017 all the way back to 2000 Easy Fast Secure Free To Try. Form 590 does not apply to payments for wages to employees.

Ad Browse discover thousands of brands. Jun 8 2021 Blog. Even though you wont owe estate tax.

The gross value of your estate must exceed the exemption amount for the year of your death before estate taxes will come due. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Wage withholding is administered by the California Employment Development Department EDD.

Federal estate tax exemption 2020 sunset. Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you. Even then only the value over the exemption.

Ad Everything you need to settle your loved ones estate. The federal gift tax has yearly exemption of 15000 per recipient per year for 2021 going up to 16000 in 2022. The estate planning environment has changed over the last decade.

Do Your 2020 2019 2018 2017 all the way back to 2000. The current estate and gift tax exemption is scheduled to end on the last day of 2025. Dad dies in 2026 when the exclusion amount is 6 million.

The State Controllers Office Tax Administration Section administers the Estate Tax Inheritance Tax and Gift Tax programs for the State of California. The Estate Tax is a tax on your right to transfer property at your death. The estate planning environment has changed over the last decade.

Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million. Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think In 2018 the Tax. Under the tax reform law the increase is.

Do not rely on the sunset provision of the tcja Between the. With adjustments for inflation that exemption in 2020 is 1158 million the highest its ever been reports the article Federal Estate Tax Exemption Is Set to ExpireAre. For more information go to.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. In 2018 the Tax. Read customer reviews find best sellers.

Maybe not tomorrow but the sunset of our historically high estate tax exemptions is comingand with the election on its way it could be sooner than you think.

Federal Estate Tax Exemption 2021 Cortes Law Firm

Estate Tax In The United States Wikipedia

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Potential Estate And Gift Tax Threat What To Do Now Lfs Wealth Advisors

2020 Year End Estate Tax Planning Part One Gould Cooksey Fennell

Preparing For The Great Sunset What You Need To Know If Tax Code Provisions Expire

Making Use Of A Spousal Lifetime Access Trust Slat Graves Dougherty Hearon Moody

The 2020 Election And The Effect On Current Gift Estate And Generation Skipping Transfer Taxes The Hayes Law Firm

No Federal Estate Tax On Large Gifts When Exemption Sunsets Ross Law Firm Ltd

New Administration New Estate Tax Complications How To Prepare Clients For The Big Shift Vanilla

Three Estate Planning Strategies For 2021 Putnam Investments

Are You Prepared For An Estate Tax Sunset Trevor Lawson

Portability Of The Estate Tax Exemption How It Works

No Expected Estate Tax Exemption Increase Under The Build Back Better Legislation

Opinion Preparing For The Great Sunset What You Need To Know If Tax Code Provisions Expire Marketwatch

Recent Changes To Estate Tax Law What S New For 2022 Jrc Insurance Group

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Locking In A Deceased Spouse S Unused Federal Estate Tax Exemption

3 More Biden Tax Proposals Understanding Potential Changes To Gift And Estate Taxes Giving To Duke